For many, paying rent to a landlord isn’t a desirable long-term solution – financially or emotionally. But, with limited mortgage options and high housing prices, it can be almost impossible to get a foot on the property ladder.

Shared ownership is a great alternative to renting and a good way to secure your own home if buying outright isn’t possible. And today, there are more than 200,000 shared ownership properties in the UK.

How does the shared ownership scheme work in England?

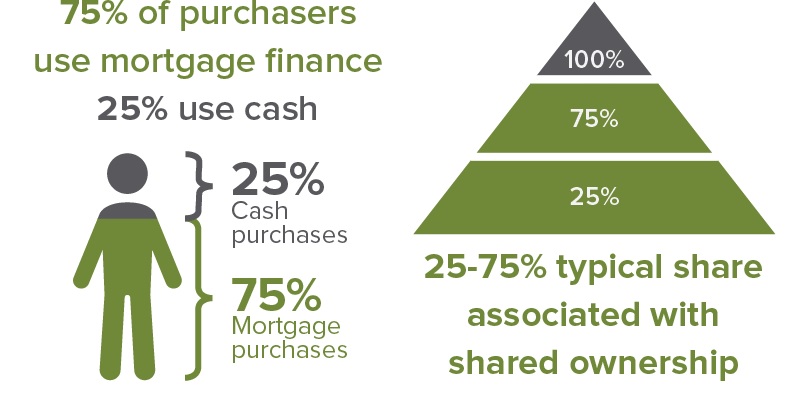

With shared ownership, you purchase a share of a property. Usually, between 25% and 75%. Typically, a housing association owns the rest. You pay the mortgage on the portion you own and pay rent on the rest.

There are similar schemes in Northern Ireland, Scotland and Wales.

The benefits of shared ownership

There are many benefits to “part buy part rent” shared ownership schemes. For example:

- Because you don’t own the property in full you only need a mortgage for your share

- You don’t need as big a deposit as you would if purchasing outright (e.g. your deposit can be 5% of the price of your share, not of the whole property)

- The rent you pay with a shared ownership property is usually a reduced rate. The larger your share, the lower your rent should be

- The standard rental conditions do not apply. For example, you should be able to decorate the property the way you want

- You have the option to increase your share over time. So, eventually you could own 100% of your home. This process is known as ‘staircasing’

Crucially, shared ownership schemes offer a low-cost ownership option to help people who can’t afford to buy an entire home.

The disadvantages of shared ownership

Despite the benefits of shared ownership, there are some drawbacks when buying a home this way.

- You may need to pay Stamp Duty. However, with shared ownership, you can choose to make a one-off payment based on the market value of the property or pay the tax in stages. Find out more

- Unlike renting, you will have to fork out for things like home insurance and maintenance fees (you are responsible for this, regardless of the size of your share)

- You can only buy leasehold properties, and this comes with additional considerations and restrictions. For example, a service charge is required. Your solicitor can advise you on this

- Some mortgage lenders are unwilling to provide funds for shared ownership

- The cost of any new shares will depend on how much your home is worth when you want to buy them. So, this could go up (or down)

- It is unlikely that you will be able to sub-let a property you part own

There are also potential issues when it comes to selling shared ownership property. For example, if you want to sell, the housing association has the right to buy it, or find another buyer before you can market it yourself.

Who is eligible for shared ownership?

You can buy a home through shared ownership if your household earns £80,000 a year or less (£90,000 in London) and any of the following apply:

- You’re a first-time buyer

- You used to own a home, but can’t afford to buy one now

- You’re an existing shared owner.

You must also:

- Be over 18 years of age

- Not be in mortgage or rent arrears

- Have a good credit history.

Also, different Housing Associations and boroughs may have their own terms regarding priorities and affordability.

Using shared ownership solicitors

Once you have found a home eligible for shared ownership, you need to go through the same process as anyone else buying a house. This includes making sure you have the required deposit and mortgage, and appointing a conveyancer.

At Optimal Solicitors, our shared ownership solicitors provide the very best legal advice delivered in plain English. We make sure you understand the pros and cons of shared ownership, your eligibility, and what buying a home this way will cost.

Average conveyancing costs for shared ownership are approximately £2,000 (legal costs). However, with fixed fees and a free initial consultation, we make the process affordable.